为了提供更好的使用体验,富达中国将使用您的Cookie。如果您点击的覆盖「接受」按钮,我们将视为您接受了我们Cookie政策。同时,您也能够随时 改变Cookie设置或查看Cookie政策。

继续操作将离开富达基金中国官网主页,跳转至投资人平台。该平台由富达基金外包服务机构招商证券提供技术支持,平台数据准确性由富达基金负责,富达基金拥有最终解释权。

主页

反洗钱

国内法律法规 国内法律法规 国内法律法规 国内法律法规 国内法律法规 国内法律法规 国内法律法规 国内法律法规 国内法律法规 国际法律法规 国际法律法规 国际法律法规 国际法律法规 国际法律法规 国际法律法规 国际法律法规 国际法律法规 国际法律法规 国际法律法规 国际法律法规 国内法律法规 反洗钱联系方式 国内法律法规 国内法律法规 国内法律法规 反洗钱动态、宣传材料及相关链接 反洗钱动态、宣传材料及相关链接 反洗钱动态、宣传材料及相关链接 反洗钱动态、宣传材料及相关链接 反洗钱动态、宣传材料及相关链接 反洗钱动态、宣传材料及相关链接 反洗钱动态、宣传材料及相关链接 反洗钱动态、宣传材料及相关链接 反洗钱动态、宣传材料及相关链接 反洗钱动态、宣传材料及相关链接 反洗钱动态、宣传材料及相关链接 反洗钱动态、宣传材料及相关链接 反洗钱动态、宣传材料及相关链接 反洗钱动态、宣传材料及相关链接

Latest survey: Chinese millennials' retirement savings rates hit new high,financial wellness is critical to enhancing millennial well-being

Shanghai, China, 27 October 2021: Fidelity International and the Ant Fortune platform today released the 2021 China Retirement Readiness Survey . The results show that retirement savings have been growing in focus for Chinese millennials (aged 18-34) as they achieved the highest retirement savings rates since 2018. However, the concept of retirement investing needs to be further strengthened. Data indicates that improving financial wellness and strengthening retirement reserves are critical to enhancing the overall well-being of Chinese millennials.

China has been accelerating the development of its third-pillar pension system in recent years in order to enhance retirement security and strive for common prosperity. While increasing awareness about retirement savings will provide an important foundation for the development of the third-pillar, continuous investor education that encourages long-term investments will also play a vital role.

Significant growth in retirement savings

The survey results show that the monthly savings rate of young people jumped from 20% in 2020 to 25% this year, with monthly savings reaching an average of RMB 1,624.

The retirement savings rate is affected by multiple factors, with 76% of the young generation indicating that they began to increase their emergency savings last year, mainly due to the effects of the pandemic. Meanwhile, compared with those over 35 years of age, the young generation has a higher goal for retirement savings. They expect to save nearly RMB 1.55 million for a good retirement life, which is considerably higher than the target of RMB 1.39 million by people over 35 years of age.

On average, the young generation starts saving for retirement at the age of 31, which is still rather late for them to accumulate savings per their retirement goals.

Imperative to encourage long-term investment

Though the young generation is making progress in increasing their savings, they still lack sound and adequate investments.

The survey found that nearly a quarter of young respondents make cash the primary component for their retirement savings. 23% percent of young respondents said that they lacked the relevant investment skills and knowledge, which made them less inclined to start investing.

Target-date funds (TDFs) aim to provide a one-stop solution to retirement investment for individuals, playing a critical role in retirement investment strategies globally. To support the development of the third pillar of China's pension system, hundreds of pension target funds successfully obtained approval and have been rolled out in China since 2018.

However, the survey findings indicate that only 16% of young respondents who already possess investment experience have heard of TDFs. Of those who are aware of TDFs, only 25% have invested in them, and a mere 15% claimed that they are familiar with the features and advantages of TDFs.

Financial wellness is closely linked to happiness

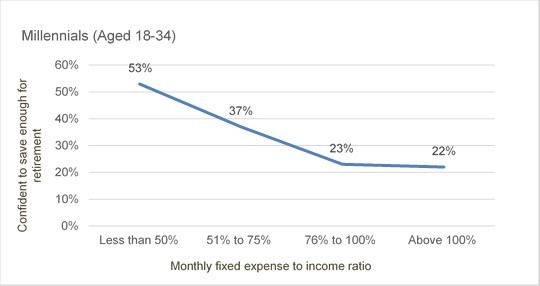

According to the survey results, 87% of respondents indicated that their financial situation is one of the key factors which affects their overall well-being. Monthly income and expenses also have an impact on the young generation's confidence in meeting their financial needs for retirement, therefore, it is instrumental to have a proper and effective budgetary plan. Data indicates that respondents whose monthly fixed expenses remain less than 50% of their total monthly income are more optimistic about achieving their retirement goals.

Source: Fidelity International, Ant Fortune

"It is encouraging to see the savings rates among the young generation in China hit new record highs. We believe the establishment of third-pillar personal accounts and the tax incentives to be offered in the future will further encourage Chinese citizens to increase their retirement savings, which will lay a solid foundation for funding their long-term investment habits,” Rajeev Mittal, Managing Director of APAC ex-Japan at Fidelity International said.

“Fidelity International remains committed to introducing our global experience in retirement investment and planning to China, guiding and assisting Chinese people to become long-term investors and take advantage of the growing third-pillar pension scheme. We are keen to help them enhance their financial wellness and overall well-being."

Guoming Zu, Vice President of Strategic Line, Ant Group, said: "Based on our joint survey with Fidelity International, we see that young Chinese people's awareness of retirement savings has definitely improved over the past years, but saving alone doesn’t mean they are ready for retirement. With the introduction of personal accounts under the third pillar scheme, we need to double down on efforts in investor education and provide one-stop services to help young people reinforce their habits of saving for retirement, and more importantly, support them to improve their knowledge and abilities in investment."

- End -

联络我们

客服热线: 400 920 9898

境外客户请拨打 +86-21-60600666

传真: 021-60119601

人工服务时间: 沪深交易所交易日 9:00-11:30 13:00-17:30

客服电邮: services@fidelity.com.cn

公司地址: 上海市浦东新区世纪大道8号国金中心二期7楼701室

本资料须获富达基金书面同意方可向外发放。本资料内所载的观点,在任何情况下均不应被视为富达基金的促销或建议。富达基金对任何依赖本文而引致的损失概不负责。有意投资者应就个别投资项目的适合程度或其它因素寻求独立的意见。虽然富达基金已尽力采取措施,确保文内资料准确无误,但不拟就有关由第三方所提供的数据出现错误或遗漏承担任何责任。

本资料仅供数据参考用途,未经富达基金的书面同意,请勿传阅或复制本资料。本资料不应被视为邀请或推介认购富达基金任何基金或产品,或邀请或推介采用富达基金的资产管理服务。

富达 / 富达国际 / Fidelity / Fidelity International指FIL Limited及其附属公司,富达基金指富达基金管理(中国)有限公司,“富达”、“富达国际”、Fidelity、Fidelity International、Fidelity International 标志及F标志均为FIL Limited的商标。富达只就产品及服务提供数据。富达投资指富达管理与研究公司。

投资涉及风险。本数据仅包含一般数据,并非认购基金份额的邀约,亦不应被视为建议购买或沽售任何金融工具。本数据所载数据只在数据刊发时方为准确。观点及预测或会更改而不需另作通知。本资料所载的证券(如有)仅供资料用途,在任何情况下均不应被视建议买入或卖出有关证券。

富达基金与富达国际、富达投资之间实行业务隔离制度,富达国际、富达投资并不直接参与富达基金的投资运作,富达国际、富达投资的过往投资业绩不代表富达基金的投资业绩,且不构成对富达基金管理基金业绩表现的保证。